The Hajj is one of the five pillars of Islam, and all able-bodied Muslims are required to perform it once in their lifetime. So, don’t waste time. Don’t let your age tick away. Don’t waste money. Plan your Hajj now.We invite you to plan for your Hajj through our various Shariah-based Hajj savings Schemes.

Currently we have 2(Two) types of Scheme. One is Mudaraba Monthly Hajj Scheme (MMHS) and other is Mudaraba Monthly Saving Scheme (MMSS).

Monthly Mudaraba Hajj Scheme is opened under the Mudaraba principle of Islamic Shari’ah. Under the above principle the client is the owner of the fund (Shaheb-Al Mal) and the Bank is just Manager of the Fund (Mudarib). This scheme is basically a savings scheme for any Muslim citizen intending to perform the holy Hajj by building up savings on monthly installment basis that may be required in future to meet his/her Hajj related expenses.

Product Features

- Fully Shari’ah compliant

- Profit is calculated on daily closing balance

- Can be opened for any tenor between 1 to 30 years

Other Features

- Mudaraba Monthly Hajj Scheme Account can be opened in the name of the individually or jointly. Underage or Minor Account may open.

- Monthly Installment size would be from Taka 500/- to Taka 100000/-. (Multiple of Taka 500/-)

- Installment Payment possible up to the last day of the following month.

- Advance installment payment possible.

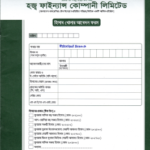

Basic Requirements

- Complete account opening form

- Personal Information of Account Holder

- 2 copies of passport size photograph of Account Holder duly attested by introducer

- 1 copy passport size photograph of nominee duly attested by Account Holder

- Identification proof like National ID Card/Passport/Driving License of Account Holder

- Signature of Introducer (if required)

- Updated TIN Certificate

- Minimum Account opening deposit will be the installment size mentioned in the Form